In the world of automotive financing, the ‘discovery phase’ is often underestimated but plays a crucial role in ensuring a successful customer experience and crafting tailored protection solutions that align with the customer’s unique situation. The significance of this phase also extends to building trust, promoting retention, ensuring peace of mind, and maintaining the dealership’s reputation.

At the end of the discovery phase, it’s vital for the F&I manager to recap the information uncovered, help the customer visualize how the risk of repairs increases throughout the ownership experience, and offer information about how they can remain protected from costly repairs after their factory warranty expires.

In this article, we’ll answer the following questions:

- What is the discovery phase and why is it important?

- How should F&I managers approach the discovery phase?

- What are the key questions that F&I managers must ask during the discovery phase?

- What happens if the discovery phase is not performed or done incorrectly?

This article also includes access to a free digital ‘Customer Analysis Worksheet’ tool. Different from most tools that only show customers their coverage over the lifespan of their ownership, this digital tool also helps F&I managers demonstrate how risks associated with repairs evolve throughout the ownership period, making the case for extended protection products.

What is the discovery phase and why is it important?

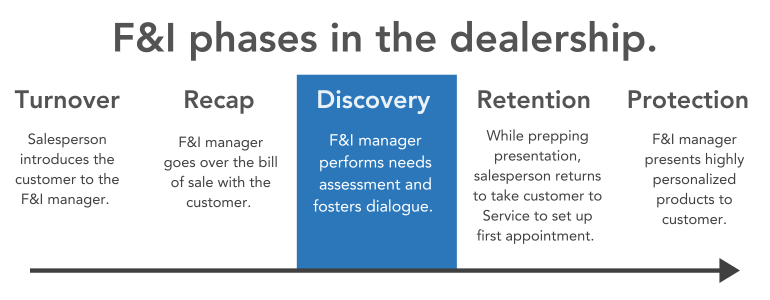

The discovery phase is a crucial part of the F&I journey and, when performed correctly, ensures a successful, personalized customer experience. Performed after going over the bill of sale with the customer, the discovery phase involves F&I managers asking the right questions and engaging in active listening to gather information about the customers’ needs, lifestyle, budget, and goals. This phase is more than just gathering basic information; it’s about forging a two-way connection, creating a personalized experience, and enabling F&I experts to craft customized protection solutions that align perfectly with the customer’s situation.

This phase is highly important to dealerships as it not only enhances the overall car buying experience, but it also:

- Ensures peace of mind: Customers can drive off the lot understanding the value of their protection products.

- Promotes retention: According to McKinsey & Company, companies that get personalization right have the potential to generate 40% more revenue.

- Builds trust: When customers feel that their F&I manager actively listened to their needs and supplied them with the right product solutions, they’re more likely to develop a trusting relationship with that dealership.

- Maintains reputation: Customers can feel confident that the dealership is acting in their best interest.

At the end of the discovery phase, it is crucial, but often overlooked, that the F&I manager recaps what information was uncovered and helps the customer visualize the protection that comes with their vehicle, i.e., the factory warranty (also known as the manufacturer’s warranty). By comparing the factory warranty coverage against how long the customer plans to keep their vehicle, it’s easier for them to understand the value of ancillary protection products and helps instill further confidence in their purchase.

How should F&I managers approach the discovery phase?

The way that F&I managers approach the discovery phase can make all the difference in a customer’s experience. Instead of adopting a formal or interrogative demeanor that might put customers on the defensive, F&I managers should strive to create a casual atmosphere that promotes active listening and meaningful dialogue. This approach not only encourages customers to share their concerns, questions, and preferences openly but also empowers them to make informed decisions about their financial choices.

In essence, F&I managers should aim to be empathetic and trustworthy experts by showing genuine interest in the customer’s needs and ensuring that the customer feels heard and valued throughout the process. Ultimately, this customer-centric approach not only enhances satisfaction but also solidifies the dealership’s reputation for providing a transparent, ethical, and tailored F&I experience.

What are the key questions that F&I managers must ask during the discovery phase?

During the discovery phase, the F&I manager will ask several questions to gain a better understanding of their customer’s lifestyle and protection needs, but the two most important questions that must always be asked include addressing the time period that the customer plans on keeping the vehicle and the estimated kilometres they drive per year.

Here is an example of how the F&I manager may consider framing these questions to ensure the customer understands and can provide the most accurate answer:

- For customers buying a car:

- “Most customers will keep their vehicle anywhere from five to seven years. How long do you see yourself keeping the new vehicle?”

- “Most customers drive anywhere from 20,000 to 30,000 km a year. Would you be closer to 20,000 or 30,000 km?”

- For customers leasing a car:

- “Do you intend to buy out the vehicle at the end of the lease. If so, how long do you intend to keep it after that, less than three years or more?”

- “Most customers drive anywhere from 20,000 to 30,000 km a year. Would you be closer to 20,000 or 30,000 km?”

What happens if the discovery phase is not performed or done incorrectly?

If the F&I manager neglects or improperly executes the discovery phase, the consequences can be significant, including:

- Presenting or selling the wrong products: Without a thorough understanding of their needs and preferences, F&I managers risk offering packages that don’t align with the customer’s individual requirements, potentially leading to dissatisfaction.

- Risking trust and dealership’s reputation: Failing in the discovery phase can erode trust, a crucial element in any business relationship, as customers may feel their concerns are not being heard or addressed. This loss of trust not only affects the immediate transaction but also risks damaging the dealership’s reputation over time as customers often share their negative experiences by word of mouth or through online reviews.

- Missing an opportunity for retention: There is also a risk of not retaining the customer because without a foundation of trust, they’re not likely to return.

- Creating confusion: When F&I managers neglect to foster a two-way dialogue and recap the value of the protection products selected by the customer, they can leave with a misunderstanding of the type of coverage that they’ve purchased, creating potential frustration if they try to make claims in the future.

- Wasting time: If the discovery phase is not performed correctly, it wastes the time of everyone involved as customers leave with an unsatisfactory experience and the F&I manager does not sell proper products that drive retention for their dealership.

Create the ultimate F&I experience for your customer with LGM’s Customer Analysis Worksheet digital tool. Access it FREE here.

As mentioned in this article, the discovery phase is an essential yet sometimes underestimated step in the car-buying journey. It is not only about gathering information and showing options for coverage, but also about guiding the customer towards a comprehensive understanding of the risks associated with owning their vehicle over an extended period of time.

Our Customer Analysis Worksheet is an essential digital tool to help F&I managers when conducting the discovery phase with their customers. Unlike most tools available from F&I providers, this tool goes above and beyond by not only demonstrating the coverage of products, but also ensuring that customers can visualize how the risk associated with costly repairs increases as the vehicle ownership continues. This helps the customer make a comprehensive, informed decision on the type of protection that is right for their ownership needs and budget.

Check out the video below for a demonstration on how the tool works and for a link to access it.

We recommend F&I managers bookmark the tool after accessing it, so they can easily return to the page with their next customer. For any support using this digital tool, please feel free to reach out to us at Sales@LGM.ca.